COVID-19 disrupted most business sectors -yes!

But there are unique implications and considerations that have greatly impacted the insurance industry. As of now, insurance corporations have been taking steps to protect their business interests. This coupled with the current challenges and uncertainties are leaving plenty of customers in the lurch. Again, this is anything but good, for an industry with a reputation that’s well less than enviable. Overall, the current economic climate and the threat of a global recession spurred by a virus that’s yet to be tamed will definitely put insurance players under significant pressure. In this guide, we discuss how industry players can rise above the crisis.

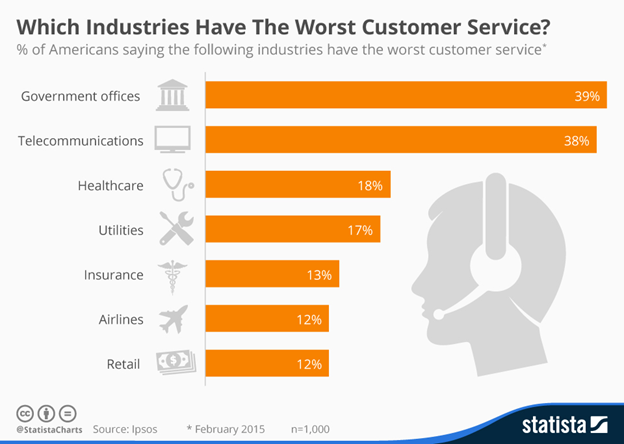

Source: Statista

Overview of the Pre-COVID Insurance Industry

Companies in the insurance industry mainly offer risk management services in the form of insurance contracts. These include players and services of diverse types, from life insurance to health insurance, accident insurance, etc.

While this industry witnessed impressive growths in the 70s and 80s, growth has been slow in recent years despite the industry still considered as safe for investment, employing about 2.8 million workers in the US, in just 2019. Here are a few points from the Insurance Information Institute, III’s, industry overview;

- There are about six thousand insurance companies in the US and its territories spread across different aspects such as property and casualty insurance, life and annuity insurance, health, fraternal, title insurance, risk retention, etc.

- The sector employed close to three million employees in 2019, across these sub-sectors.

- Insurance industry contributed about $630 billion to the US GDP, representing about 2.9% of the country’s national GDP, according to the Bureau of Economic Analysis.

- Premium taxes paid by P/C and life/annuity insurance subsectors in 2019 amounted to $23 billion, representing an average of $72 for each person living in the US.

- According to the Property Claims Services, PCS, property and casualty insurance claims in the US in 2018 resulted $49.5 billion payouts. The industry recorded about 55 major catastrophes in 2018 compared to 46 in the previous year.

COVID-19 Implications for Insurers

Despite recent economic turbulence, the insurance industry has managed to generate decent growth and appears well-positioned to manage the crises of a pandemic or just about any other crisis. But there are still market volatility issues as well as financial implications for both the long and short terms.

As far as the coronavirus pandemic is concerned, the life insurance sub-sector is most likely to bear the most brunt. But while there’s a need to closely monitor the potential impacts of COVID-19 on mortality rates, this segment might also face other challenges arising from the financial markets, considering the life insurance segment globally manages about $20 trillion in assets.

And despite all of these economic and financial challenges, insurance companies still have to bear the responsibility of maintaining positive client relationships for the best possible experience. This is necessary to survive the competition despite the general industry reputation.

Scaling Customer Service and Support to Rise Above the Pack

Customer service and experience have always been key differentiators in different industries. This holds true for the insurance sector, even now that insurance clients would most likely have more challenges to deal with.

At One Contact Center, everything we do revolves around helping business in the insurance sector and beyond create outstanding positive experiences for their clients. Even in the face of a pandemic, this is still very important. To win with exceptional customer experience, we recommend;

- Maintaining active communication throughout the entire client journey from consultation to purchase, and further.

- Personalize interactions across multiple channels, for different phases of client management and relationships.

- Finding the right balance of both technology and humans for support and other services.

It takes more than just paying lip service to excellence for companies to achieve positive insurer-customer relationships. Again, it may require the services and assistance of professionals who are trained and skilled at helping businesses manage and nurture customers for a superb customer service and support experience. This sums up the entirety of what we do at One Contact Center.

If you’d like to give your insurance business a push to excel even in the face of coronavirus, upping your customer service game is one thing you can’t do without. If you’re badly thirsting for growth, you can contact us at OCC today to help redefine your clients’ customer service experience!